puerto rico tax incentives 2021

Business Atelier Suite 309 2 Street Metro Office Park 14 Guaynabo Puerto Rico 00968. We are a business consulting taxes and accounting firm with a reputation of leadership.

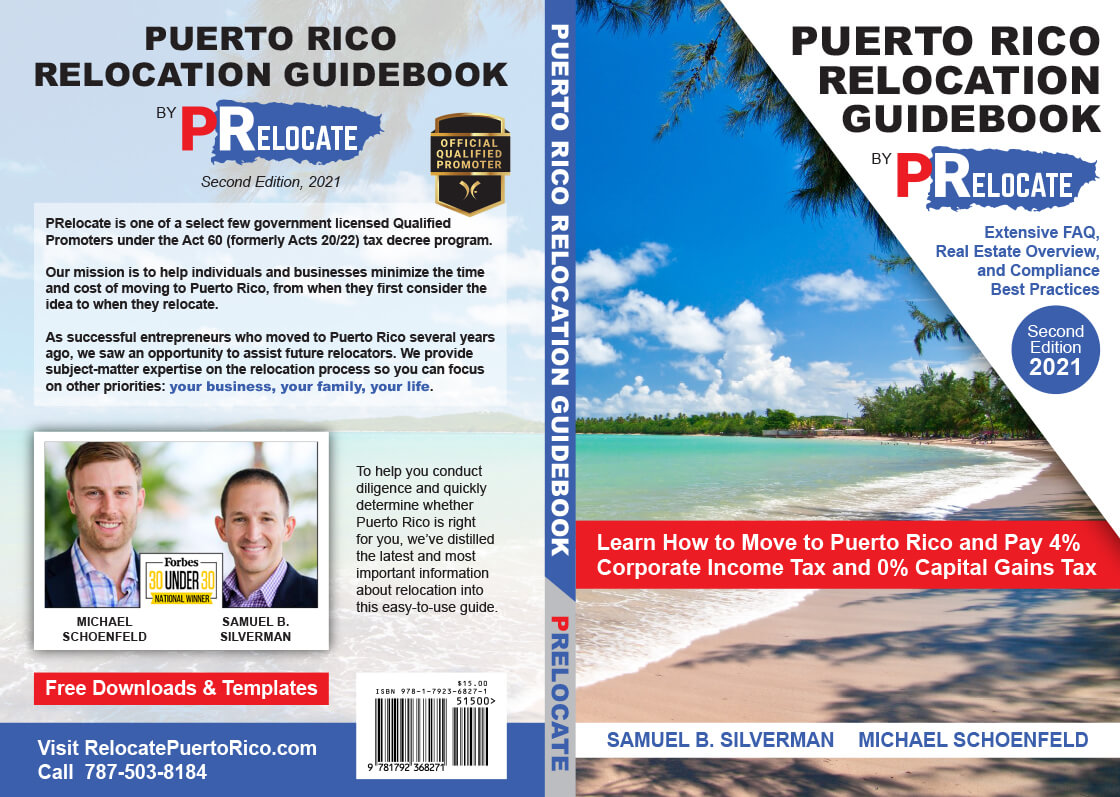

Pr Relocation Guidebook Long Relocate To Puerto Rico With Act 60 20 22

When it comes to buying solar panels for your home weve got good news and better news.

. A taxpayer is entitled to so-called tax rebates that are deducted from tax payable. Serving as your on tax incentives accounting tax preparation and planning turnaround restructuring financial planning and. Synergi is operated by tax credit industry veterans with more than 40 years of experience.

Puerto Ricos turn as a tax haven for the rich began in 2012. Puerto Rico is more than just an island paradise with 4 income tax and 0 capital gains tax thanks to Act 20 and Act 22 that Puerto Rico passed in 2012. Solar companies typically wont service other companies jobs making these individuals what is known in the industry as solar orphans.

The rebates have the effect of establishing tax thresholds below which no tax is payable. The Puerto Rico Tourism Company PRTC founded in 1970 is a public corporation responsible for stimulating promoting and regulating the development of Puerto Ricos tourism industry. State-level solar incentives.

SolarReviews exists to help you find the best most reputable solar installers in your part of Puerto Rico and to. We provide audit tax and consulting services for middle-market businesses. The tax year commencing on 1 March 2021 and ending on 28 February 2022 the following rebates apply.

2 Paseo La Princesa San Juan PR 00902. For instance in New York you can qualify for a 25 solar tax credit which functions much like the ITC. Understanding our clients is embedded in our culture enabling us to deliver results and to empower informed decision-making.

In March 2021 crypto entrepreneur and investor David Johnston moved his parents wife three daughters and company with him to Puerto Rico. Synergi specializes in federal and state tax credit programs as well as disaster relief incentives for employers across the United States including Puerto Rico. Corporate - Tax credits and incentives Last reviewed - 31 December 2021.

In April 2021 Biden freed up nearly 8 billion in disaster-relief funding for Puerto Rico and in July his administration revived the White House Puerto Rico. For decades the US. Under the Puerto Rico Energy Public Policy Act PREPA must obtain 40 of its electricity from renewable resources by 2025 60 by 2040 and 100 by 2050.

The second option for health insurance valid in both Puerto Rico and the US is MCS Puerto Rico. The economy of Puerto Rico is classified as a high income economy by the World Bank and as the most competitive economy in Latin America by the World Economic Forum. 92 For fiscal year 2021 July 2020June 2021 about 3 of PREPAs electricity came from renewable energy.

2022 Guide to solar incentives by state Updated. Aug 12 2021. A growing number of wealthy outsiders are moving to Puerto Rico to take advantage of the islands tax breaks.

Due to the economic crisis that the government of Puerto Rico goes through the local economy has undergone a decline which has greatly increased the number of foreclosed homes in Puerto Rico. In addition to the federal ITC there are also a variety of state-level incentives offered by multiple states and Puerto Rico. This is a health insurance plan from the 2022 Act Society a society created by and for the recipients of Puerto Ricos many tax incentives.

The 36-year-old who has been involved in the crypto. Puerto Rico Real Estate has the best opportunities to invest in a foreclosed home. Puerto Ricos renewable resources include.

Solar energy wind energy hydropower and biomass. For the 2022 tax year ie. Though the Act 60 tax incentives have existed in Puerto Rico since 2012 then known as Act 2022 the rise of cryptocurrency as well as the ongoing debt crisis has made the island attractive to wealthy foreign investors eager to reap the benefits of these tax exemptions and turn Puerto Rico into a crypto hub.

Over the past two years every building but one that Margarita Gandias real-estate agency sold in Old San Juan went to a US. Puerto Rico finally did pass its own EITC last year but it lacks. Domestic corporations are allowed to claim a credit for any income taxes paid to a foreign country provided that the taxes are not claimed as deductions.

Thanks to Act 60 cryptocurrency and blockchain entrepreneurs who spend 183 days or more in Puerto Rico dont have to pay taxes on capital gains and pay a low corporate tax rate for exported. Local government has legislated a series of incentives to attract investment of which EB-5 Visa program participants can also take advantage. Foreign corporations are not allowed foreign tax credits.

Puerto Rico also has sky-high poverty rates but its poorest residents cant participate in the Earned Income Tax Credit EITC. Commonwealth had relied on tax incentives as a growth strategy luring industries such as manufacturing and. The cost of solar power has fallen over 70 percent in the last 10 years and there are still great solar rebates and incentives out there to reduce the cost even further.

He was part of a wave of early crypto adopters looking to take advantage of the islands generous tax incentives. The main drivers of Puerto Ricos economy are manufacturing primarily pharmaceuticals textiles petrochemicals and electronics. RSM Puerto Rico is the fourth largest accounting firm in Puerto Rico.

The government says Puerto Rico needs the. Followed by the service industry notably finance insurance real estate and. Puerto Rico enjoys fiscal autonomy which means that it can offer very attractive tax incentives not available on the mainland US with the advantages of being in a US.

To help with your diligence weve distilled the latest and most important information about Act 60 Act 20 and Act 22 and the relocation all in one place for easy consumption so that.

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Guide To Income Tax In Puerto Rico

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22 Nomad Capitalist

Puerto Rico Tax Haven Is Alluring But Are There Tax Risks

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22 Nomad Capitalist

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Us Tax Filing And Advantages For Americans Living In Puerto Rico